eBanking Launch in Days!

Launch Your Digital Banking

Unlock the full potential of your financial institution with C2Bank’s cutting-edge White Label All-in-One Banking solution

- No need for an in-house IT

-

We handle the platform build

and ongoing maintenance

saving you the time and expense of managing IT - No licensing required

- Operate under our licensing umbrella with full regulatory coverage no need to secure your own license.

- Compliance made easy

- Seamlessly transform to an acquiring bank and get free access to all necessary functionality

- Enrich your basic capabilities with direct Visa/Mastercard connectors

- Become a payment orchestrator or aggregator with unlimited capabilities for integration.

Reduce time to market and save money with white-label

Launch in days instead of years

- Building a banking platform from scratch can take 4 to 8 months, encompassing development, regulatory approvals, and testing. With our solution, all that work is done for you.

Pay a fraction of the price

- Creating a banking platform can cost up to €100,000, encompassing hiring developers, managing infrastructure, and ensuring compliance. Our white-label solution eliminates these costs.

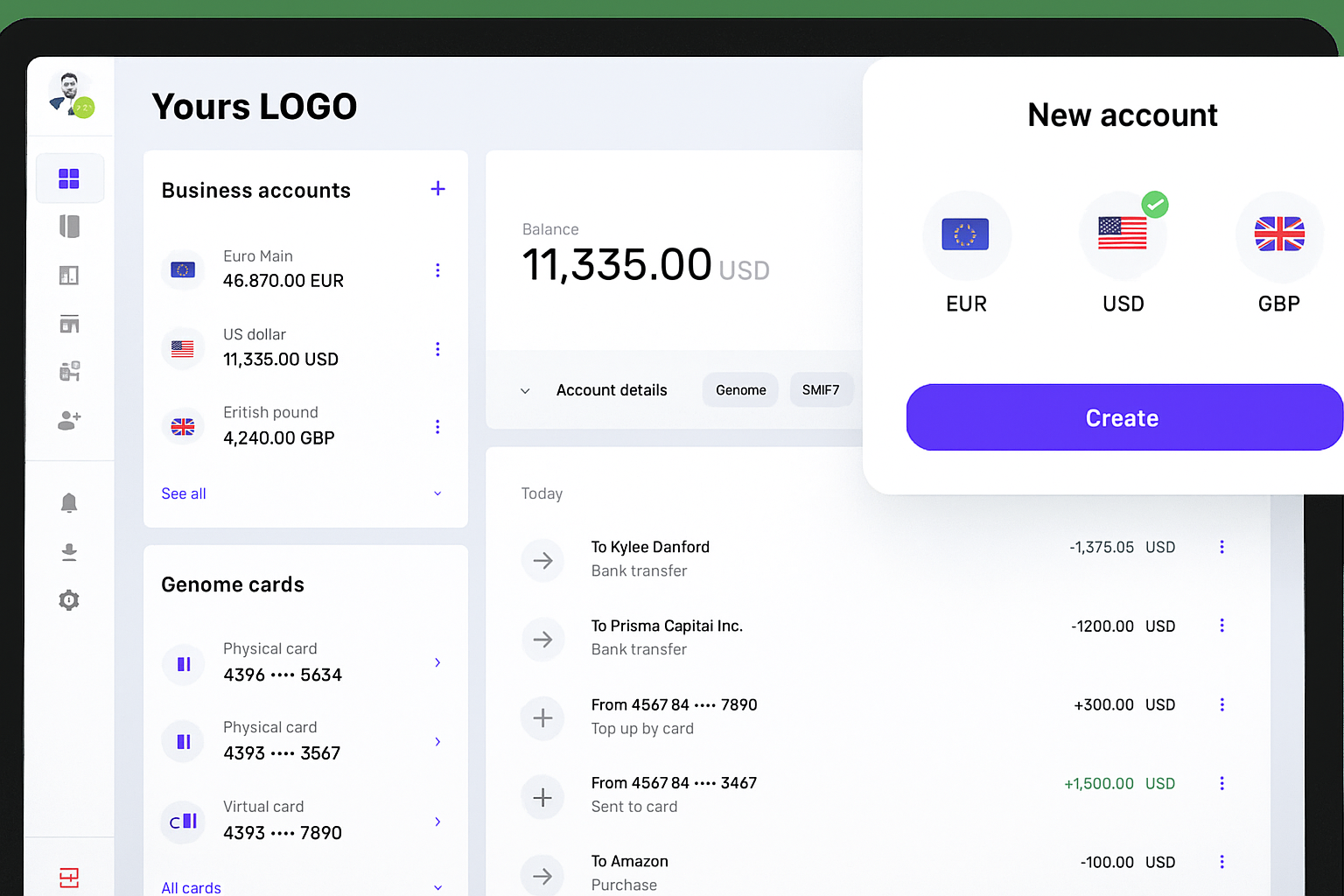

A complete banking platform your customers will love

- Prevent fraudulent transactions with powerful scoring features and stay reliable for payment systems and merchants.

- Automate compliance with the terms of your contracts with merchants.

- Become your own bank manager, generate IBANs, issue virtual cards, and manage multi-crypto channels all in one place.

- Maximize conversion rates with self-learning antifraud algorithms that analyze payer behavior and existing fraud reports, and reroutes suspicious transactions.

- Accept payments online Offer your customers a variety of payment options ranging from debit cards, credit cards and eChecks to digital payments like Apple Pay and PayPal.

Your banking platform

- From SEPA Instant payments to multi-IBAN support, our platform delivers everything you need for secure, seamless banking, ensuring the safety of your customers’ funds.

- Customise everything from your logo and colours to typography, ensuring your online banking platform aligns with your brand’s visual style. Create a cohesive experience for your customers, effortlessly.

- No-code flexible customisation. Launch a fully functional, branded banking platform with just a logo and a few clicks.

Fast Delivery!

Enjoy hassle-free maintenance and significantly lower costs compared to traditional API-based BaaS solutions.

Get ready to launch in no time, fully customised to your requirements.

Operate under your own domain, with full white-label branding, complete bank control, and seamless management of your merchants and clients.

Fast, easy, and professional.

🚀 Key Benefits

100% White-Label under your brand

Own domain, own clients, own profits

Fast setup, go live in days

Full compliance & infrastructure managed by C2Banks

Unlimited growth potential with flexible fee markups

Yes! With the full white-label plan, you can connect your own domain (e.g., yourbank.com) so your clients only see your brand not ours.

What does “full white label” mean?

It means the entire platform runs under your name and design. You get your own branded banking system, logo, colors, and dashboard. C2Banks operates in the background your users interact only with your brand.

Do I manage my own clients?

Absolutely. You have full control over your personal and business clients, including account creation, verification (KYC), limits, and activity tracking.

Can I manage merchants too?

Yes, the platform lets you create, onboard, and manage merchants directly from your admin panel. You can monitor transactions, balances, and settlements in real time.

Is setup fast?

Very fast! You can launch your own branded banking system within days, customized to your business requirements.

Choose Your White-Label Plan

You decide the level of customization and services you need from simple IBAN & card issuing to full multi-crypto and merchant banking.Brand Integration

We connect your domain, logo, and brand identity. You’ll have your own URL (e.g.,yourbank.com), color theme, and client dashboard — fully white-labeled.System Setup & Configuration

C2Banks team sets up your back office, client panels, payment gateways, KYC/AML flow, and optional crypto or merchant modules.Testing & Approval

You test the full system (cards, payments, client sign-up, notifications, etc.). Once approved, we go live.Launch & Manage Your Bank

Start onboarding clients and merchants under your brand. You manage everything from your admin dashboard, including users, balances, transactions, and support.

Ideal for entrepreneurs or fintech startups who want to offer a simple, ready-to-use banking platform.

Includes:

Virtual & physical card issuing

Card loading via crypto

Unlimited card generation

Crypto deposit and withdrawal options

Full branding under your own domain and logo

Ability to markup all fees and earn profits from transactions, card orders, and wallet usage

💰 Cost: Contact us for setup and monthly pricing

(One-time setup + monthly platform fee applies)

Perfect for businesses that want to serve personal and business clients (B2C + B2B) under their own banking brand.

Includes everything in Starter, plus:

Ability to onboard and manage businesses (B2B)

Issue named IBANs and dedicated accounts to each client

Multi-currency & worldwide IBAN options

Expanded admin dashboard for advanced client control

Higher scalability and earning potential

- CARDS

- BANK ACCOUNTS

- ON-RAMP (Card → Crypto)

💰 Cost: Contact us for setup and monthly pricing

Designed for large institutions aiming to operate as full PSP providers.

Includes everything in Advanced, plus:

Onboard and manage merchants directly

Offer card processing and over 50+ PSP payment solutions worldwide

Support for PIX, UPI, Interac, PayID, Open Banking, and more

Your clients can also offer sub-services and earn on top

Full control of mid-cost markups and merchant settlements

- CARDS

- BANK ACCOUNTS

- ON-RAMP (Card → Crypto)

- Card Processing for High-Risk Merchants

💰 Cost: Contact us for setup and monthly pricing

No license is required.

You can launch your white-label platform as any registered company whether you’re an existing business or starting a new e-banking venture.

We perform a basic KYB (Know Your Business) verification to understand your company and intended use. Once approved, we can close the deal and start setup immediately.

Within a short time, your fully branded e-banking platform will be live under your own domain, ready to onboard clients, issue cards, and manage accounts.

Fast, simple, and compliant your bank, your brand, your clients.

Since you’re after “all in one working solution”, here are what you should ensure are included and what to ask:

Named IBAN accounts in your business name (not pooled account).

Support for major currencies (EUR, GBP, USD) and a strategy for “other currencies” (check which).

Virtual cards + tokenisation so end-users can add card to Apple Pay / Google Pay.

Wallet capability: download/load funds, fiat ↔ crypto conversion, hold crypto, spend crypto.

Crypto loading / support: rules around which crypto assets, custody, on-ramp/off-ramp, regulation.

Compliance & licensing: depending on your business model (especially if crypto involved).

White-label branding and full customer-facing front-end + your own business name on accounts/cards.

Operations & support: customer service, disputes, card issuing partner, liquidity/FX.

Integration (APIs) and optionally ready-to-go dashboard (if you want minimal dev).

Pricing, set-up fees, monthly account/card fees, FX/crypto conversion fees, country/region limitations.